nc estimated tax payment voucher

If you failed to pay or underpaid your estimated taxes for the past tax year you must file form D-422 to calculate any interest or penalties due with your income tax return. Complete spouses information if you and your spouse plan to file a joint return.

Quarterly Tax Calculator Calculate Estimated Taxes

How you can complete the NC tax payment voucher 2013-2019 form online.

. Unemployment Insurance Tax PO. Income Tax Instructions for Form100000 ----- 6787 50 7 75 of the amount over. Ad Download Or Email NC D-400V More Fillable Forms Register and Subscribe Now.

For calendar year filers estimated payments are due April 15 June 15 and September 15 of the taxable year and January 15 of the following year. Quarterly Tax Payment Voucher. DES Central Office Location.

Include either a payment voucher or your name social security number the type of tax and the applicable tax yearperiod with your check or money order. Each payment of estimated tax must be accompanied by Form NC-40 North Carolina Individual Estimated Income Tax. Make all checks or money orders payable to NC.

NC Department of Revenue Post Office Box 25000 Raleigh North Carolina 27640-0630. Business Recovery Grant Program Phase 2 of the Business Recovery Grant program is now open. How you can complete the NC tax payment voucher 2013-2019 form online.

Our decision is based on information provided to us by our payment processor. Fill Out and Sign North Carolina Estimated Tax Voucher Form You must refer to the Individual Income Tax Instructions for FormYou must refer to the Individual Income Tax Instructions for Form100000 ----- 6787 50 7 75 of the amount over 10000014 If the irst payment. Schedule payments up to 60 days in advance.

Opt to pay online as this is the most secure and efficient way to make a payment. Each payment of estimated tax must be accompanied by Form NC-40 North Carolina Individual Estimated Income Tax. Please do not send cash.

NC Department of Revenue Post Office Box 25000 Raleigh North Carolina 27640-0630. PDF 11177 KB. If you have filed Employers Quarterly Tax and Wage Report electronically and you wish to mail in your payment this form must accompany your check or money order.

For details visit wwwncdorgov and search for online file and pay For calendar year filers estimated payments are due April 15 June 15 and September 15 of the taxable year and. Click here for help if the form does not appear after you click create form. Enter Your Information Below Then Click on Create Form to Create the Personalized Form D-400V Individual Income Payment Voucher.

NORTH CAROLINA DEPARTMENT OF COMMERCE DIVISION OF EMPLOYMENT SECURITY Unemployment Insurance Tax PO. For calendar year filers estimated payments are due April 15 June 15 and September 15 of the taxable year and January 15 of the following year. Use this step-by-step instruction to complete the NC tax payment voucher 2013-2019 form quickly and with perfect accuracy.

Please enter different bank information or pay by creditdebit card. Quarterly Tax Payment Voucher. Where in turbo tax may I find North Carolina 2021 estimated tax vouchers.

Pay individual estimated income tax. Do not print this page. DIVISION OF EMPLOYMENT SECURITY.

Raleigh NC 27611. Complete form D-429 to determine the. Use the Create Form button located below to generate the printable form.

Individual Estimated Income Tax. Click here for help if the form does not appear after you click create form. Sign Online button or.

Customers needing assistance with their unemployment insurance claim should contact us via phone at 888-737-0259. Form D-400 is the general income tax return for North Carolina residents. Use the Create Form button located below to generate the printable form.

Quarterly Tax Payment Voucher - English. Box 26504 Raleigh NC 27611 Quarterly Tax Payment Voucher If you have filed Employers Quarterly Tax and Wage Report electronically and you wish to mail in your payment this form must accompany your check or money order. You can also pay your estimated tax online.

Click here for help if the form does not appear after you click create form. Many businesses that did not qualify in Phase 1 are now eligible to apply in Phase 2. To begin the form use the Fill camp.

Read the rest of the tutorial to discover more about North Carolina Estimated Tax Voucher Form including what they are and what should go into them. 7 Mail the completed estimated income tax form NC-40 with your payment to. PDF 49105 KB - January 24 2022.

You can also pay your estimated tax online. Box 25000 Raleigh NC 27640-0630 MI. Box 4513 Houston TX 77210-4513 for more information.

700 Wade Avenue Raleigh NC 27605 Please note that this is a secure facility. NORTH CAROLINA DEPARTMENT OF COMMERCE. Individual Estimated Income Tax Web North Carolina Department of Revenue 1-20 NC-40 Cut and mail original form to.

Link is external To pay individual estimated income tax. They are for you to print and send in with your estimated payments this year. Do not print this page.

Use the editable template on CocoSign website to make a North Carolina Estimated Tax Voucher Form securely. The zip code you entered was not the zip code. 6 Enter your social security number on your check or money order.

Enter Your Information Below Then Click on Create Form to Create the Personalized Form NC-40 Individual Estimated Income Tax. Enter Your Information Below Then Click on Create Form to Create the Personalized Form CD-V Corporate Income and Franchise Tax Payment Voucher. Use the Create Form button located below to generate the printable form.

We encourage you to call TeleCheck at 1 800533-1018 or write TeleCheck Customer Care at PO. D-400 can be eFiled or a paper copy can be filed via mail. They are scheduled to be finalized on 217.

Ad Download Or Email NC D-400V More Fillable Forms Register and Subscribe Now. 2022 Form NC-40pdf. Apply now through June 1 2022.

Department of Revenue PO. 6 Enter your social security number on your check or money order. Department of Revenue PO.

You should be able to e-file now and you will be able to print the vouchers properly without making any modifications once they are finalized. Customers needing assistance with their unemployment insurance. Make one payment or.

Raleigh NC 27605 Please note that this is a secure facility. The estimated payment vouchers do not get e-filed with your return. This resource is related to.

Browse Our Image Of Dependent Care Receipt Template Receipt Template Receipt Templates

Pin On Us Tax Forms And Templates

Business Taxes Annual V Quarterly Filing For Small Businesses Synovus

What Does The March 1 Deadline Mean For Farmers Center For Agricultural Law And Taxation

Memo Onlyfans Myystar Creators Business Set Up And Tax Filing Tips Chris Whalen Cpa

/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

Schedule K 1 Beneficiary S Share Of Income Deductions Credits Etc Definition

New Mexico Personal Income Tax Spreadsheet Feel Free To Download Income Tax Income Tax

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Need A School Tax Form Templates Here S A Free Template Create Ready To Use Forms At Formsbank Com School Tuition School Address Private School

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

City Income Tax Return For Individuals Spreadsheet Tax Return Income Tax Income Tax Return

Quarterly Tax Calculator Calculate Estimated Taxes

Bac Chart 2 Download The Free Printable Basic Blank Medical Form Template Or Waiver In Word Excel Or Pdf To Be Used As A L Chart Template Printable Templates

Need A Deductions Working Sheet Paper Size A3 Here S A Free Template Create Ready To Use Forms At Formsbank Com Paper Size Deduction Sheet

1040 Apply Overpayment To Next Year

Business Registration Application For Income Tax Withholding Sales And Use Tax And Machinery Equipment And Manufacturing Income Tax Registration Tax Forms

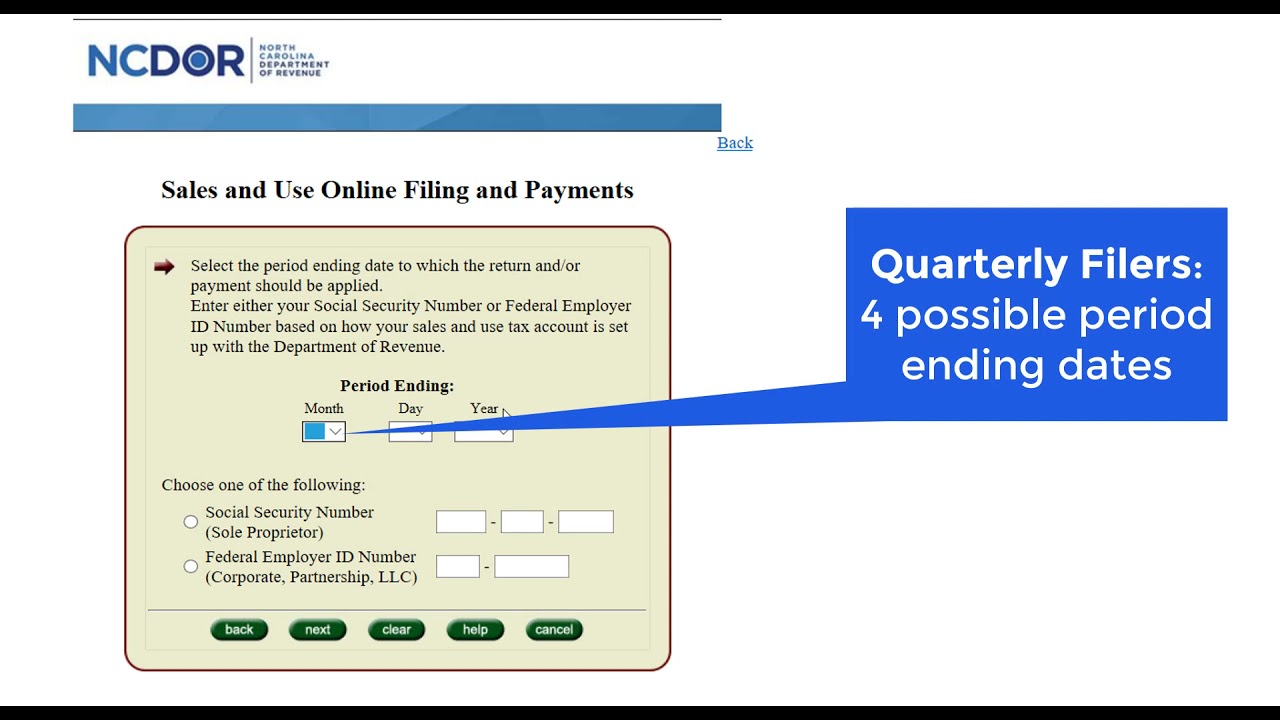

Online File Pay Sales And Use Tax Due In One County In Nc Youtube

Use Direct Pay To Securely Pay Form 1040 Series Estimated Or Other Individual Taxes Directly From Your Checkin Internal Revenue Service Savings Account Paying